I take my responsibility as an EXCLUSIVE buyer’s advocate very seriously. I have been saying for many months, now is the time to get into the market, but very few people listened.

The recover in the housing market, not only in Massachusetts, in many parts of the country has occurred faster than we thought it would. My concern is that the market does not understand the new dynamic and that will create discontent and an unreasoned lack of agreement between buyers and sellers.

Now that the summer season has officially ended we are seeing a deluge of properties coming onto the market For those sellers who wanted to spend one more season in their Island homes before they put them on the market, the time has come and that is why we are seeing the appearance of some really nice properties.

And for some who have been suffering the discomfort of their evaporated portfolios, their hope for the kind of seasonal rental income that would support their vacation homes until next summer, that income may not have materialized due to the soft summer rental market, so those properties are now for sale.

For property owners who were smart enough to refrain from cluttering the inventory until the market showed signs of recovery because they were not distressed and did not have to sell; they are being induced to test the waters again. Their reemergence is fueled by a pervasive attitude that the economy appears to be improving, along with statistics to support the fact that the bottom has generally come and gone.

“The percentage of listings with price reductions declined slightly from July to August, and when sellers did slash their asking price they made smaller reductions”, according to a national study by Zip Realty.

In another study done by Zillow.com comparing listing prices to selling prices during July, “U.S. homebuyers paid 3.3 percent less than list price on average, down from 3.5 percent in June and 4.6 percent in January”.

Although we are seeing an apparent rush to market on both sides, the fact is buyers can no longer assume owners with properties for sale are highly motivated, In fact, we have been at the bottom of the market for a while now and the horizon is clearly brighter for sellers than it has been in the last 5 years. I received this email from a local bank the other day:

“Our mortgage staff reports that there are a lot of inquiries, a lot of requests for prequalifications, and applications have begun to pick up…all of this is certainly a good sign that the market is a "happening" place. People are obviously past the point where they are just perusing the real estate guide and trying to figure out just how low they can convince a seller to go…..this rate reduction should be a further spur to deals being made. We all wish you the best of luck this fall…to paraphrase my favorite Irish saying, ‘May the wind always be at your backs from now on!!’"Here is positive spin demonstrating that the

region shows signs of rebound.

The real estate market cannot be rated as a good or a bad market because what is good for one can be bad for another. For the last 3 years it has been considered bad for sellers because no one was buying, yet if a buyer decided to make a purchase, the market was good for them. I think we can all agree the recession has bottomed out and with interest rates still historically low --- under 5%, and with no immediate signs of inflation; this is still an excellent time for buyers to take advantage of once in a lifetime opportunities. But it is also good for sellers. Sellers are no longer feeling as though they are being thrown to the wolves. The market is starting to balance out and sellers are feeling more hopeful and empowered.

In order for you as a buyer to be successful you need to adjust your thinking a little bit and keep your eye on the prize --- a home on Martha’s Vineyard.

1) You are no longer in total control so your expectations of ‘take no prisoners’ will no longer work.

2) You will no longer be able to present a litany of demands to sellers and expect them to acquiesce. You need to be reasonable and willing to leave something on the table --- choose your fights.

3) You have to look at your investment opportunity from the standpoint that the market has gone down anywhere from 10 to as much as 30 percent in some areas and in some price lines. So no matter what, you have to realize you are making a much better purchase than you would have within the last 4-5 years.

4) You have to be willing to negotiate, be patient, be flexible and in the end remember that Martha’s Vineyard is a lifestyle, an emotional decision as well as one of the better long term investments you will make. This Island is a finite commodity and it is not growing any larger.

For buyers today what is most important is to have good representation by a skilled negotiator. Someone who is knowledgeable about the entire market, someone who will thoroughly investigate all details of the property you select so you are fully informed and not surprised later on by things you did not know about. You want someone who will represent you 100% throughout the process and be there for you afterward. You want an exclusive buyer agent. You want SplitRock Real Estate, LLC.

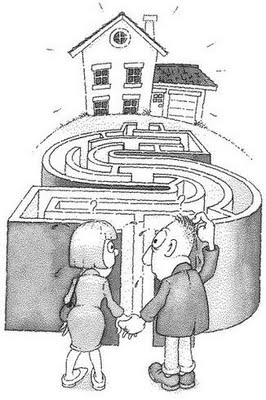

Entering into the home buying process is like wandering through a corn maze, you can make a lot of wrong turns if you are without a knowledgeable guide who knows the way.

Labels: Buyer Agency, Buying Martha's Vineyard Real Estate, Buying Real Estate, EXCLUSIVE Buyer Agency, exclusive buyer agent, luxury homes, second-home, SplitRock Real Estate, vacation home