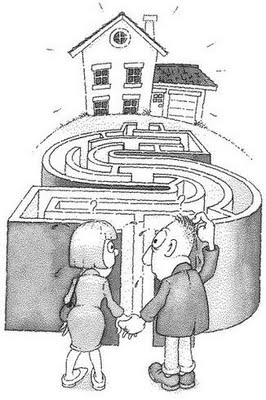

2008 was a very tough year. I think we all felt, or should have felt the pain by now. My business is real estate. Much of the focus nationally as well as locally has been on what has happened to the real estate market. Most of the talk is negative as are immediate future predictions. Negative thinking is easy.

In my latest SplitRock Real Estate e-Newsletter, I directed my readers to an article that appeared in the MV Times, “The Reality of the Martha’s Vineyard Real Estate Market”. My clients and readers know that I have been giving them the same information for quite some time now, but it is nice to hear it from another real estate professional and to look at it in terms of bar graphs. More importantly, it is important to be reminded that this is merely a cycle we must go through, as we have done many times before. As the author said, real estate markets go through regular cycles of (3)5 years down and (7)10 years up. Even the stock market goes through cycles, and theirs are usually 20 to 25 years. I’ll admit we are in a real pickle right now because it is not just the United States that is suffering; this is a global meltdown and the ripple effect is affecting everyone which will result in a prolonged overall recovery. What I found most interesting about the MV Times article was one of the reader comments. Here are some excerpts of that reader’s rather harsh perspective:

“As tragic as this downturn is for the local economy, and as much as it may usher in a different era ahead, I feel a bit glad and relieved about it all.“I have come to believe that economic progress is actually opposite of quality of life. “I am someone who first feel in love with the Vineyard in the 1960's. It has not improved since then. In fact, as we get richer by material standards. It actually gets poorer. Material progress has simply been ruining the place. We just adjust to the incremental changes and are, therfore, less likely to notice.“It is barely distinguishable from the places we came here to escape.“The growth has diminished the Vineyard's most precious jewels....what we get for free. We have simply over-exploited it.“Economic ruination would be the Island's salvation, in non-material terms. Now, there's an alien concept, indeed. “Ruin is rebirth.“It's of little matter to me, though. I have already moved off-island to another place that reminds me of the love I had for the Vineyard so long ago. I come back to visit now and again, and am, frankly, quite happy to leave.”

I remember when I first came to the Vineyard in the ‘60’s with my parents; they no longer enjoyed summering in ‘the Hamptons’. Martha’s Vineyard was a very quiet place and not too many people knew about it. The ‘Natives’ were typical New Englanders, and not very forthcoming or welcoming, but once they accepted you they were the best. I think one of the circumstances hindering population growth on the Vineyard was transportation, and that factor more than anything isolated the Vineyard from America, but that is irrelevant at this point.

I find it curious that the MV Times reader moved away from the Vineyard, but yet he still follows Island news. His acrid comment above reminded me of a developer who ran through the Vineyard in the ‘80’s like a swarm of locust, and then abruptly left for greener pastures. He was asked by a news reporter in his new location why he left. He said, ‘The Vineyard is like an old lady who has lost her charm’. Sure the Vineyard has become more crowded and sure we have once again seen carpetbaggers come and go. But the Vineyard has really not changed that much --- honest! I know people who have lived all over the world and in crowded urban areas who swear this is where their soul is at home, and this is where they will come to recharge themselves, bond with family and loved ones, and where they will live out their days when they retire --- or before.

The Martha’s Vineyard Gazette published a wonderful commentary in their print paper, but unfortunately they did not put it on-line. The article was written by the late CBS correspondent, Don Hollenbeck, who sadly committed suicide in 1954, possibly caused by the effects of Malaria. It is not clear when he wrote his article, but it was most likely at least 50 years ago. I think the article demonstrates the colorful fabric that those who really know and understand the Vineyard realize is still very much in tact. The title of the Gazette commentary was taken from the last line of Hollenbeck’s article, ‘there are no Islands anymore’, and that line was actually the title of a poem by Edna St. Vincent Millay, written in 1940. Keeping in mind the time line of these writings, I want to preface Hollenbeck’s reflection with a couple of paragraphs extracted from Millay’s work:

Dear Islander, I envy you:

I'm very fond of islands, too;

And few the pleasures I have known

Which equalled being left alone.

Yet matters from without intrude

At times upon my solitude:

A forest fire, a dog run mad,

A neighbour stripped of all he had

By swindlers, or the shrieking plea

For help, of stabbed Democracy.

We live upon a shrinking sphere—

Like it or not, our home is here;

Brave heart, uncompromising brain

Could make it seem like home again.

(There are no islands any more.

The tide that mounts our drowsy shore

Is boats and men,—there is no place

For waves in such a crowded space.)

I hope you enjoy the warm spots in Hollenbeck’s article as much as I did. Please rest assured, what was great about this Island 50 years ago still exists, you just have to slow down and look a little harder.

There are No Islands Anymore, Only a Certain State of Mind

Editor's Note: Don Hollenbeck was a CBS correspondent and journalist who produced a radio show in the late 1940s during the Edward R. Murrow era, titled CBS Views the Press. He was also a summer visitor to the Vineyard and was interviewed in the Gazette in 1949. Mr. Hollenbeck, who committed suicide in 1954, is the subject of a recently published biography authored by Loren Ghiglione (CBS's Don Hollenbeck, Columbia University Press). A distinguished journalist in his own right and professor at Northwestern University's Medill School of Journalism, Mr. Ghiglione is also a longtime Vineyard visitor. In researching his book, Mr. Ghiglione came across this undated piece about the Vineyard which was written by Mr. Hollenbeck. It is published here with permission.

By Don Hollenbeck, date unknown

"This is out of the world, but this is America: This is our country. Picture an Island of triangular shape, a hundred miles in area, lying seven miles off the southeast coast of Massachusetts; an Island which is all things to men. This Martha’s Vineyard described as a place of old towns, new cottages, high cliffs, white sails, green fairway, salt water, wildfowl, and the steady pull of an ocean breeze.

"This is a land of contrasts: from the brazen honky-tonks of the town known as Oak Bluffs, with its jukeboxes, its gaudy post cards, its bus drivers hawking for business and its revival season, to the well-bred quiet of Edgartown, with a social air twice as rarefied-as that of Newport, to the view from Indian Hill, 260 feet high.

"There one stands and views the prospect: to south and east stretches a level plain of dwarf forest top without a sign of civilization. To the west, there are rocky outcrops and tree-filled ravines, and to the north, the cerulean blue of Vineyard Sound. Of this world and yet out of it might apply of all places to Martha's Vineyard; it meets perfectly the need so often felt for a retreat; for a quiet time of contemplation, when, as in this springtime, one may leave the noise of the jukeboxes at Oak Bluffs, and listen only to the sound of the frogs the Islanders know as pinkletinks.

"This is the land Leif Ericson may have visited in the eleventh century - on a tiny island eight miles off-shore - and island called Noman's Land, you may view a boulder, and on if, if your imagination is cooperative, you may see dimly scratched the numbers 1004.That date is accepted by some devout Islanders as good enough evidence that this is the land Leif Ericson found and named Vinland; indeed, the wild grapes grow in profusion on the Island, which in area only may be compared to Manhattan island, 150 miles away, and which is, in a different sense, all things to all men . . ..But the contemplative man finds on Martha's Vineyard other things to think about than he does on Manhattan island, now that spring is coming.

"A pink and white mayflower is blooming h the office of Miss Mary Nunes, the Oak Bluffs tax collector; a weather-wise Islander has reported the arrival of the first red-winged blackbird. Islanders know that the red-winged blackbird has advance and inside information about the weather; spring cannot be very far behind.

"We live with the sea here on Martha's Vineyard; the sea is our fortunes and our fate: what the sea gives us is our livelihood. We See signs of spring on the sea, too, in a fishing boat. Now the wind breezes from the south'ard; the sea which can be cold and hostile through the winter seems more friendly now - it is blue under the warmer sun instead of icy-gray: and in" the beach pools, there are flocks of ducks and coots squawking.

"The sparrows, too, seem to have inside information on the springtimes, and are busy picking up straws for their nests. It is impossible for a man to get too downcast when the sun shines on the blue water around Martha's Vineyard at this time of year when the wind has veered to the south'ard: light airs they are indeed, fragrant with the promise of the season.

"Soon it will be the time when a man can go out and get enough sassafras bark to brew a pungent cup of tea: this is the decoction which in New England seems to clear away the miasma of winter, and which gives one the proper feeling of springtime.

"There seems to be a sort of greenish mist around the bare branches of the trees now; at any time, the lilac hedges will burst into aromatic color, complementing perfectly the silvery, weather-worn look of the shingles and the wood in the sea-salt laden air of this Island so close to, and yet so far from, the rest of the world.

"Soon the chestnut tree over the smithy in Edgartown will be showing signs of transfiguration, and Orin Norton, the blacksmith, can open doors of his forge, and beat up the sparks to the admiration of the children - they would never think Longfellow's poem over-sentimental or shopworn: the village blacksmith is a real person to the children of Edgartown. Now, in the fire-lit gloom of the forge, Orin Norton talks to you about the six-hundred pound anchor which he has just completed. He says, "it's such a darned good one that I figure I ought to charge a little less for it than usual." "Now why in the world why?" you ask in real astonishment at this paradox. "Well," Orin says,"it's like this. I think the man who ordered it will be perfectly satisfied. In that case, he won't be coming around here finding fault, and taking up my valuable time, so I’ll be the gainer if I knock 'something off."

"This is the-spirit you find repeated again and again on Martha's Vineyard where the tempo of the world seems to have slowed down in the winds that veers from the mainland to the sea and back again. You find it in the case of Carl Reid, who runs the general store in the town of Menemsha -this is the fishing town where the air is almost always full of the aroma of lobster bait, drying in the sun. You may ask Mr. Reid for fish hooks, only to be told that he isn't carrying them this season. "People bothered me too much about 'em -had to fuss too much," Mr. Reid says. It would please him if there were only one brand of everything, from cigarettes to molasses, and the people couldn't pester him, fretting about labels, and so on.. . .When you come to Martha's Vineyard, you must note expect the usual standards to apply, to repeat, it is of this world, and yet out of it. It has its own standards of conduct and department, and off-Islanders, as the permanent population calls the summer vacationers, sometimes have difficulty in understanding this.

"The steady population of Martha's Vineyard is about six hundred; in the summer, it is nearly seven times that figure. You may go there year after year, and become friendly to a point with the regular inhabitants, but if you are an off-Islander, you are never quite accepted . . . Oscar Flanders, who drives a truck, may call you by your first name, but it may be two years or more before you feel sufficiently at ease to call him by his first name, and then you are self-conscious about it: there is a delicate point of etiquette involved here which you must understand instinctively and emotionally, rather than logically . . . . Not long ago, a general of our Army was spending a holiday on the Vineyard, relaxing thoroughly in civilian clothes. He was well known to the steady population; he had been a summer person for several seasons.

"Almost anywhere in the world, a general of an Army, even in mufti, seems to get special consideration; he is usually exempt from small trials and tribulations which beset the rest of us. Our age-old awe of, and respect for, the soldier, force us into a deference which may be difficult to rationalize, but which nevertheless exists.

"One day the general, perhaps preoccupied with a matter of logistics concerning the purchase of a pack of cigarettes, drove his automobile through a stop light in Edgartown – a flagrant violation of a traffic ordinance. Almost anywhere else, the traffic officer recognizing him would probably have let him off with a courteous and deferential reminder, but not on Martha's Vineyard.

"The general got a ticket, and as the policeman said, he considered the general entitled to special consideration only when he - the general - was on duty. And he wasn't on duty on Martha's Vineyard . . . .

"But there have been soldiers on duty on Martha's Vineyard in recent years, and their presence simply emphasized the far-away-and-long-ago quality of the Island. Although these soldiers were only seven miles over the Sound from the Commonwealth of Massachusetts, they were considered to be on duty outside the continental limits of the United States; they drew correspondingly bigger pay, and they were entitled to wear the Atlantic ribbon . . . .

"But nowhere could one find more vividly exemplified the spirit of Martha's Vineyard than in another reference to the Flanders family - the truck driver whom you hesitate to call by his first name. The Flanders have a son, and some years ago, before the world was set afire, young Flanders as a public school student, was assigned the task of writing an essay on Mussolini. At that time, the late dictator was arousing a certain amount of admiration for making the trains in Italy run on time. But young Flanders saw him in a rather different light: his essay began with these words: "Mussolini is an off-Islander . . . ."

"But there have been changes in the world, and again, the case of young Flanders shows what they have done to Martha's Vineyard. Mussolini became something other than an efficient administrator and train operator; others of his sort came to power, and young Flanders growing up, found himself a member of the United States Army Air Force in the Pacific.

"He was off-Island at last, and he gave a good account of himself: he won the Distinguished Flying Cross. And as he moved from island to island in the Pacific - islands like and yet unlike his own home, he must have come to the realization that many others of his generation have come to in the past few years: there are no islands anymore, not even Martha's Vineyard. "

Well, that's it. Now I ask you, what's your state of mind?

Labels: Martha's Vineyard Real Estate, Retirement homes, second-home